Shortlist active investors from our network

From our network of around 30,000+ investors, our targeted business development model and investor qualification process will pre-qualify and shortlist relevant investors.

5 STEP SUMMARY

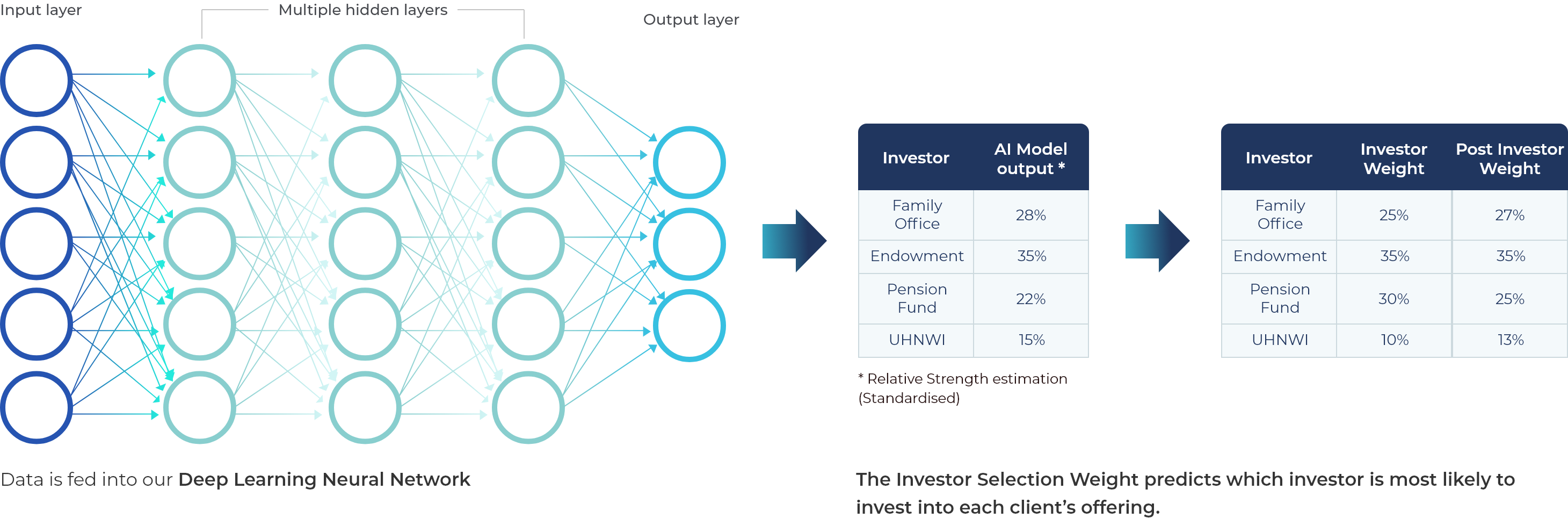

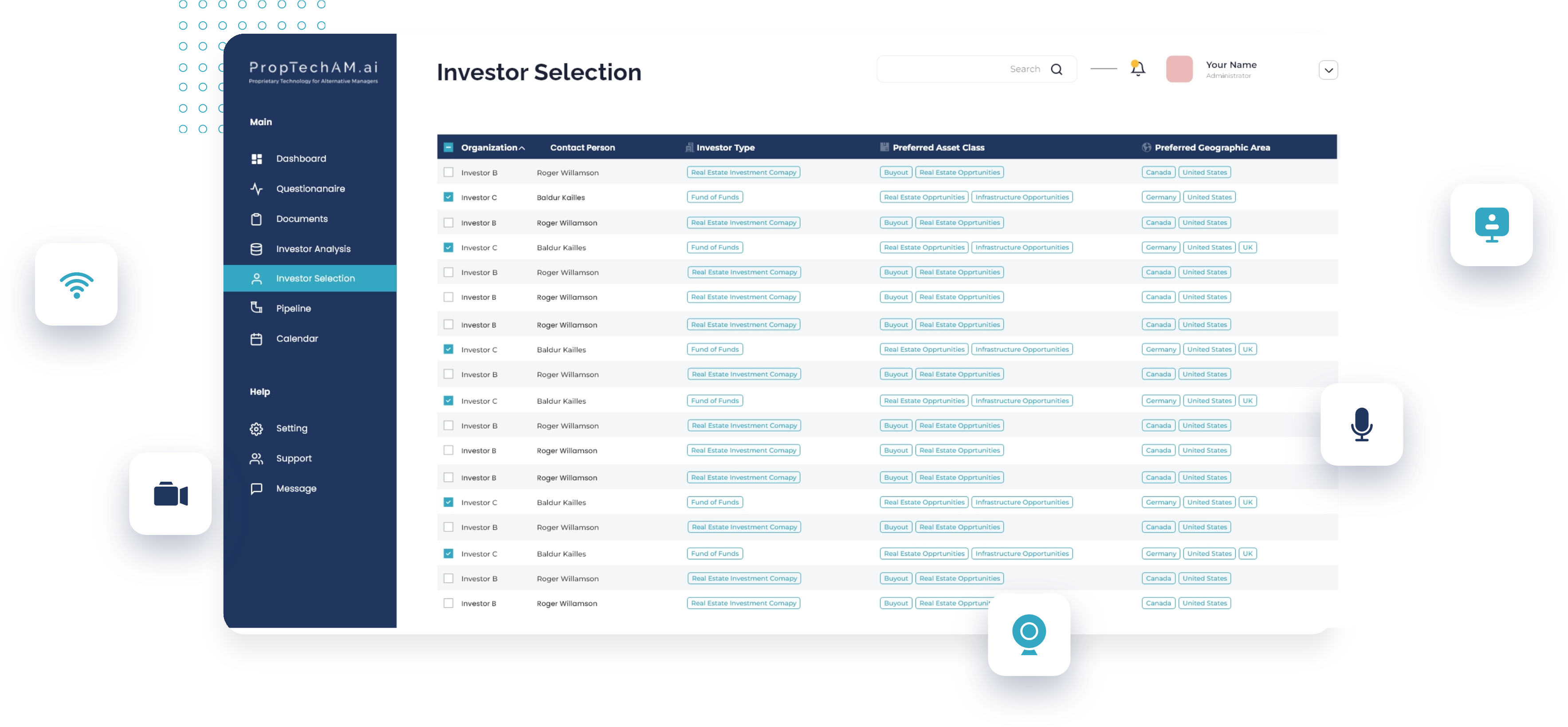

Clients access the platform and complete our questionnaires.

Our AI matchmaking algorithm uses this information to match each client with the most suitable and pre-qualified investors in our network.

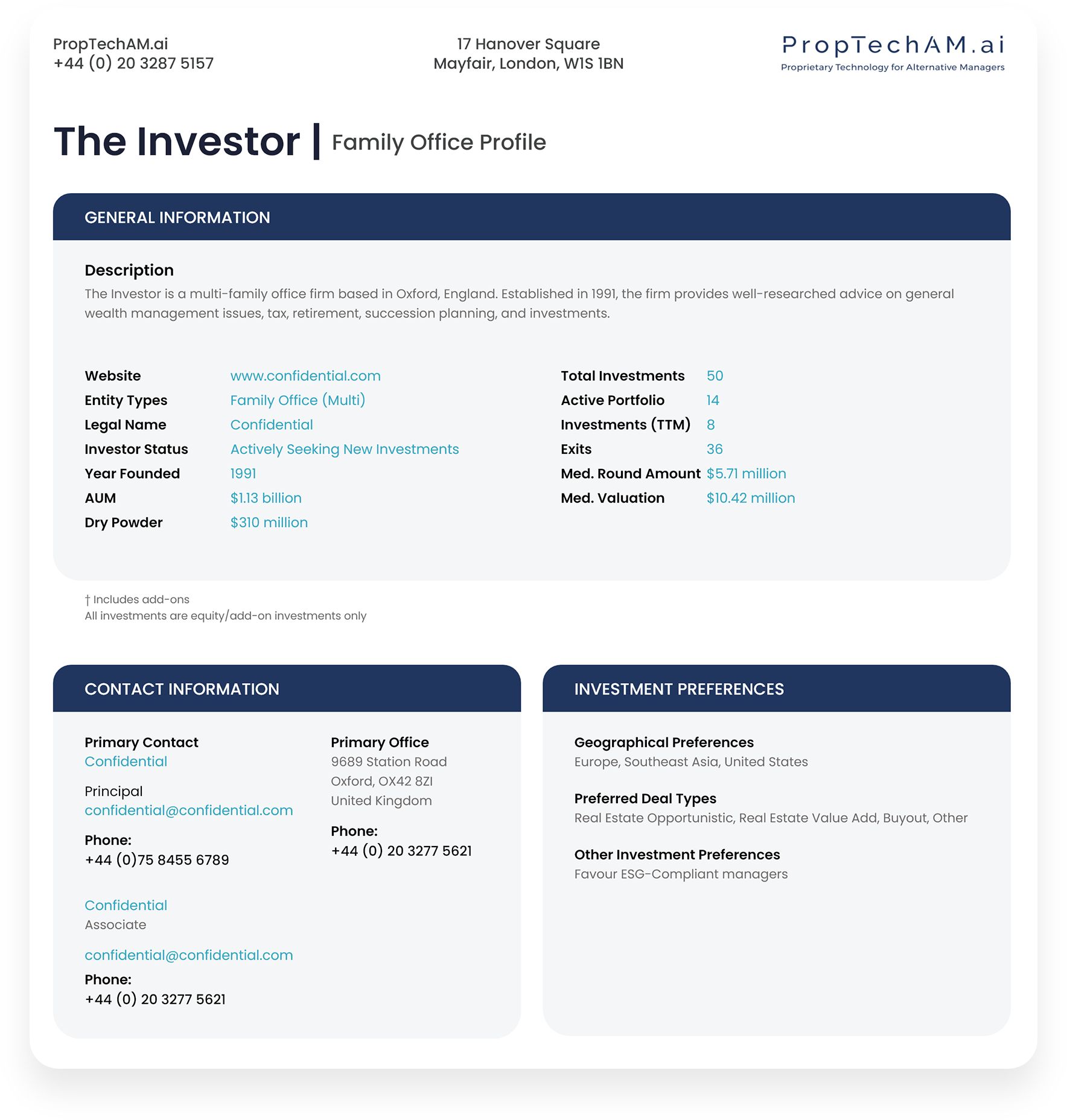

The list of suitable investors is presented to clients for approval.

We connect with the approved investor on behalf of the client and organise a video call.

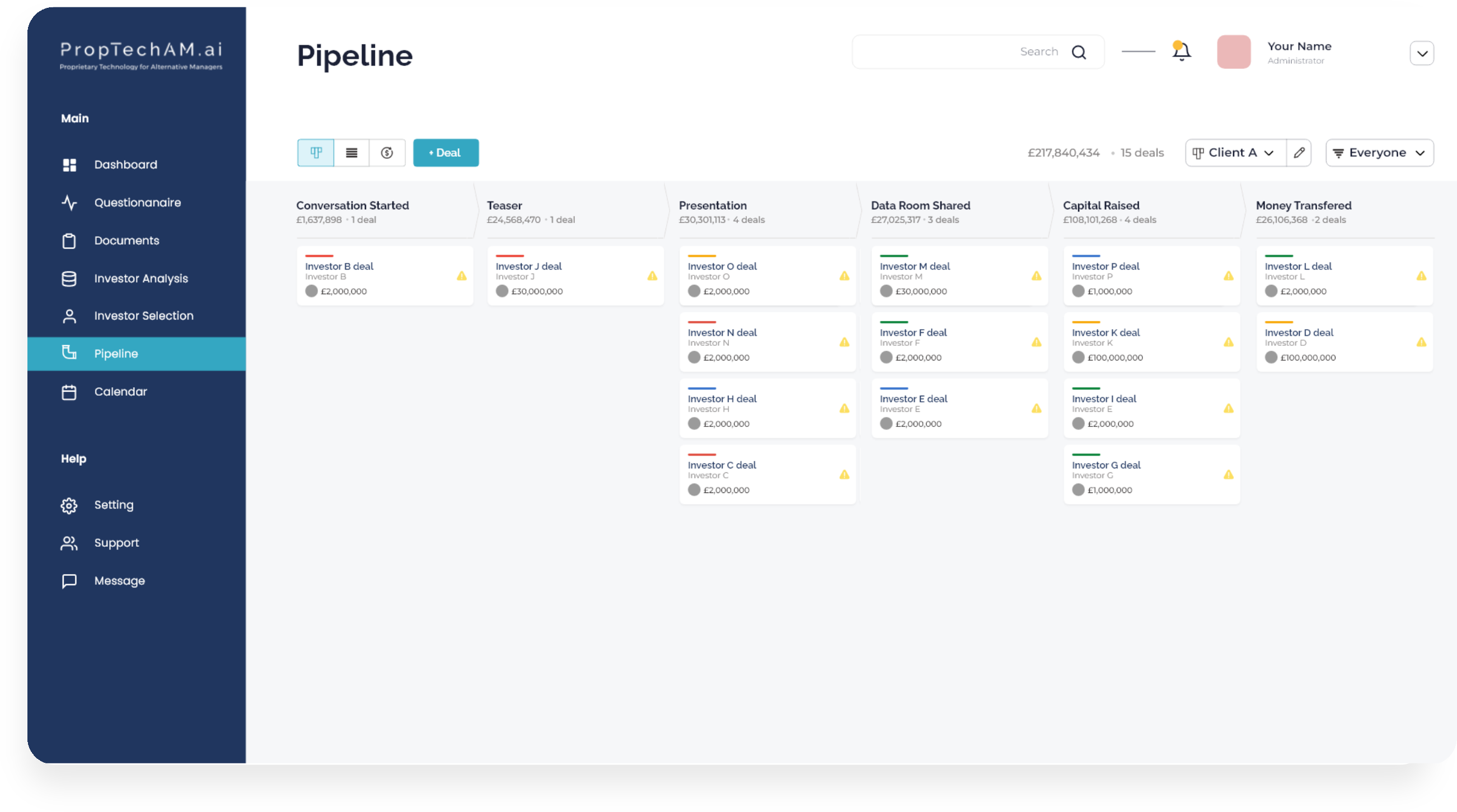

The client takes over from there and closes the deal while we support the client.

From our network of around 30,000+ investors, our targeted business development model and investor qualification process will pre-qualify and shortlist relevant investors.

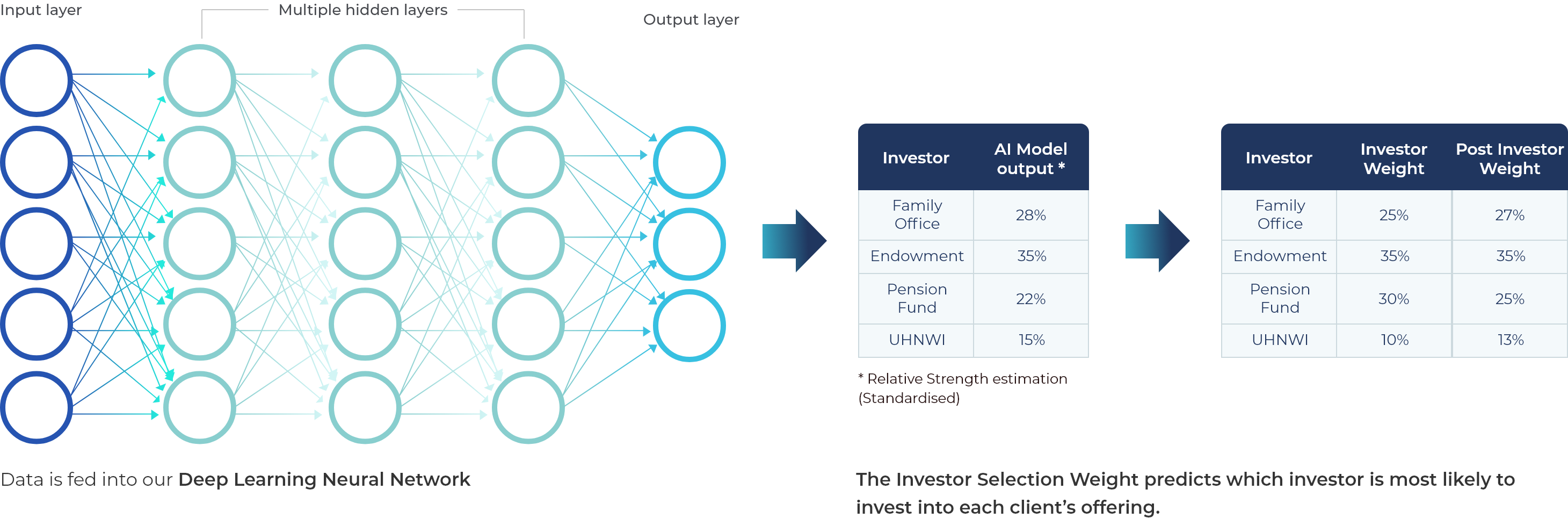

Our consultants are in continuous discussions with the investors to further qualify them and generate the following information:

Information collected from the shortlisted Investors is passed over for review and selection of investors to target. We then contact relevant investors on your behalf, create awareness, and confirm their interest in your investment product.

We market the client’s offering among suitable investors and invite interested parties to video calls. This has proven to be the best method to introduce our clients to investors, but we also organise in-person meetings if required by the investor.

We charge both a retainer and a bonus fee on capital raised from investors introduced by us. The size of both the retainer and the commission is defined by the number of markets targeted.

Get Started