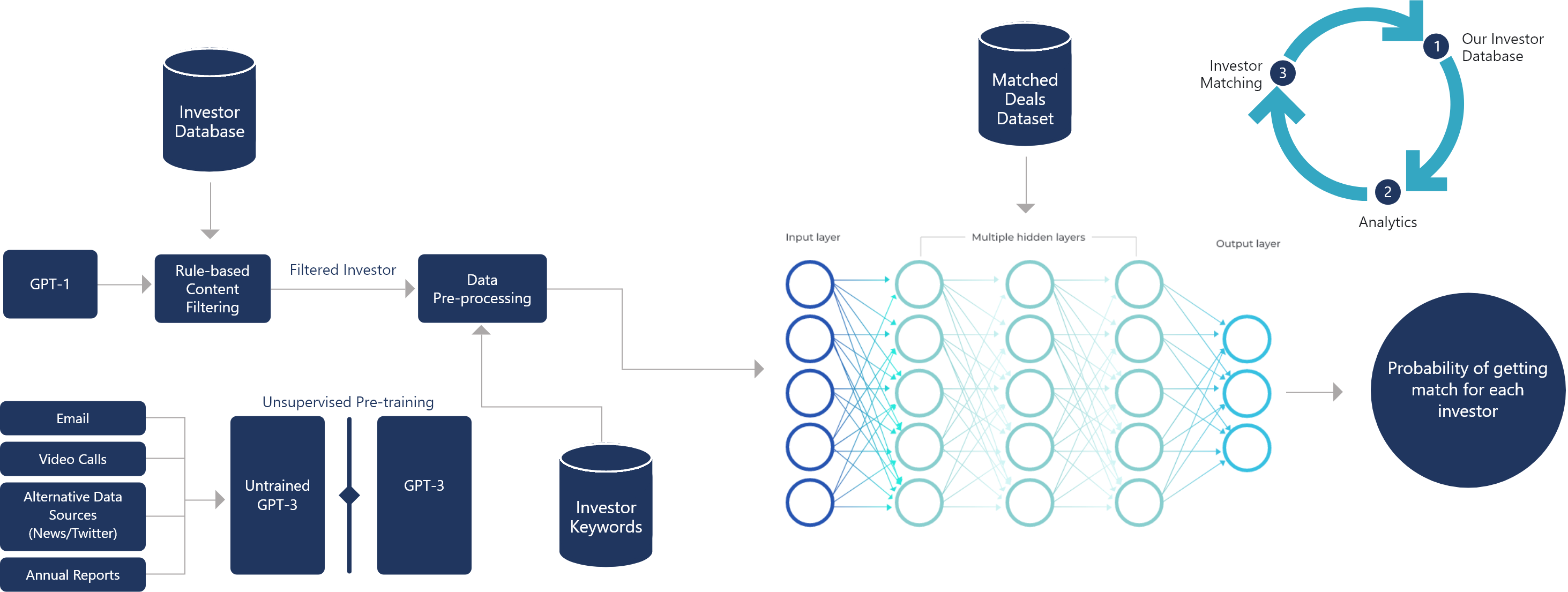

Our AI Fundraising Platform

We use artificial intelligence (AI), big data, and our software-as-a-service (SaaS) platform to find the most suitable investors for our clients.

We understand each client’s distinctive investment strategies and unique work styles and match them with the most suitable investors who are looking to invest capital, after conducting industry research, market analysis, detailed investment modelling, valuation analysis, investment memo writing, and data analytics.

We have established long-term connections with investors. Our platform opens up new markets for both fund managers and firms by connecting them to a global network of 30,000+ investors.

Our AI investor selection model selects suitable investors for our clients in seconds. This allows our clients to focus only on the most suitable and pre-qualified investors.

We make human interaction more efficient by introducing our clients to the most suitable investors via video calls. Afterwards, we support our client until the capital is raised.

By applying artificial intelligence to our client’s capital raising processes, we replace the manual inputs (collection and cleaning of data), and manual selection of suitable investors and augment the work of investor relations managers. This brings in substantial benefits, such as:

Selection of suitable investors happens in a matter of minutes rather than days or weeks.

Our AI algorithms are unbiased and can account for many more factors in real time than a person. This improves our selections' quality.

By automating most of our clients’ fundraising processes and becoming less dependent on humans, our clients can scale up easily, taking on more investors in less time and with less work.

Considering that our investor database contains more than 30,000+ institutional investors, family offices, and high-net-worth individuals, it would take a significant amount of time to manually identify the best investors for our clients.

Our SaaS platform powered by AI is automated:

For each client, AI performs the functions of data collection, data updating, and data matching.The individualised process begins once the 30 most suitable investors are identified for each client.

We provide direct access to a global network of

We have up to 150 data points per investor. Artificial intelligence takes over the tasks of data gathering, updating, and matching for each individual client.